Embracing Uncertainty, Funding Passion and Taking (Calculated) Risks: Why I’m Joining CoinFund as Head of Venture Legal

I first heard the words ‘cryptocurrency’ and ‘blockchain’ back in 2017 when a friend told me how much money he had made trading tokens. “DV, it’s like shooting fish in a barrel, ” he told me with a straight face. As a former investment banker at Citigroup and, at the time, an associate practicing transactional law at Kirkland & Ellis, I did not give it much thought. I was too busy managing private equity acquisitions and believing the only real returns were in leveraged buyouts (LBOs) and what we now refer to as TradFi, or traditional finance. Cryptocurrency and digital assets sounded like a sci-fi novel to me at first. I decided to skim the Ethereum whitepaper, most of it admittedly over my head, but I became intrigued by the underlying notions of decentralized systems and smart contracts. While this curiosity got me comfortable enough to invest part of my next bonus check in a few currencies, I never really envisioned working in the space full time. As luck would have it, the investment immediately lost most of its value and I made a promise to myself to hold on to it, but only until it came back to its original price (at which point I swore I would sell.) Long story short, that time came and went and I am still holding on to that original investment.

Fast forwarding to today, to think of myself as a transactional attorney practicing in the crypto space still feels a bit surreal. Talking about it with folks outside of the industry (including family) feels like those early tech crusaders trying to explain what the internet was in 1997 — “What do you mean computers talk to each other?” Much like the early internet, crypto opens the door to even the ‘unknown unknowns’ with use cases that we cannot currently conceive of. I have always been drawn to technology and outsized opportunities, both qualities of crypto, which I also know firsthand come with their own risks. While lawyers tend to be a risk averse group of people, one of the things I appreciate most about practicing transactional law is the opportunity it affords to be creative and think through out-of-the-box solutions to drive true value. This was a skill I learned early on, always trying to fashion myself as a lawyer who tries to find every reason not to say No to a business team, but rather work to understand the business incentives so that I can find an innovative legal structure or solution. While in law school at the University of Southern California (USC), I pursued a joint MBA degree because I realized that a deep understanding of business principals was a powerful combination in my practice. These fundamentals helped me fashion novel LBO structures for my clients while at Kirkland, and are why I raised my hand to lead crypto deals as Lead Counsel & General Manager of The Chernin Group’s Crypto Fund (TCG Crypto). They will provide me with the same inquisitive and collaborative energy at CoinFund, working with our investment team and founders to build mutually beneficial partnerships.

In my experience, practicing law and advising on dealmaking means constantly learning — even more so in crypto as the technology and infrastructure surrounding digital assets continue to evolve at lightning speed. This is one of the lessons I stress the most to my students as a Lecturer in Law at USC. While law can be a stuffy and structured affair at times, understanding its nuances is how we can apply past learnings to the present. Crypto is a perfect example for students of how dynamic the law can be, and how we both successfully and unsuccessfully (depending on who you ask and in what context) adapt pre existing structures to accommodate present applications. This is how I approached my time at TCG Crypto, where I was able to supplement my transactional practice with a new layer, learning the idiosyncrasies of crypto transactions over the course of multiple investments in a new crypto dedicated fund. These skills also come in handy as we try to create new transaction structures in crypto; yes, crypto needs us attorneys too! As the industry adds more institutional capital and matures, it is vital that informed and seasoned professionals are able to apply their skill sets to this new technology. This is how we can level up the industry and avoid missteps of the past.

What I have found in crypto is not just a potentially transformative technology, but also a community of passionate entrepreneurs and professionals. An example of this came early on when I was part of a team tackling crypto from a consumer angle. I did not initially understand the NFT craze, but after multiple rounds of questioning my colleagues, attending NFT conferences and meeting multiple founders, investors and NFT enthusiasts, it finally began to click. I learned about the community aspect of NFTs, bought a few of my own and began to engage in the circle around them. Funny enough, although a digital identity, my wife decided to print physical stickers of my first NFT and put them on a few of my belongings. I began to feel an attachment to this digital identity, something I had never understood in the past.

But these are just a few of the reasons I am all in on crypto and CoinFund.

Throughout my legal career, I have always been drawn to projects and opportunities that foster creativity and embrace calculated risks, which are essential ingredients for driving meaningful progress in any rapidly evolving industry. CoinFund’s commitment to exploring innovative solutions and pushing the boundaries of what is possible within the crypto space aligns perfectly with these values and the team and ethos here epitomize this spirit. As I became more immersed in the crypto space, I decided that I wanted to join a fund which was, like me, fully dedicated to crypto, web3 and blockchain. That was when I was introduced to David Pakman at CoinFund. I realized from those initial conversations that the team at CoinFund not only shares this fundamental belief in the technology, but they are also accomplished professionals from other industries bringing their skills and experience to crypto along with a deep technical know-how. David explained his vision of the new Venture Legal role — to provide valuable strategic advice on investment terms and structure from the outset, to lead execution with the investment team and give them back time to focus on deal flow and sourcing and to provide additional support to CoinFund’s current and future portfolio companies. This need is a great fit for me, not only based on my prior experiences, but also due to my desire to be a legal partner with the investment team in the quest for value creation and to build out a strong and consistent execution function. As most other funds are being cautious or cutting back on their investments and teams, CoinFund has been blazing ahead, taking on more talent, raising additional capital and using it to support additional founders. CoinFund is composed of individuals with the core beliefs aligned with those of crypto itself and who are truly here to champion the leaders of the new internet. I was ecstatic when I was asked to join the team on this journey and I remain so to see what we can build together.

While the start of my interest in crypto was not exactly like shooting fish in a barrel, I am happy to say that it has become part of my identity in more ways than one.

Twitter: @DilveerVahali

***

Disclaimer: The views expressed here are those of the individual CoinFund Management LLC (“CoinFund”) personnel quoted and are not the views of CoinFund or its affiliates. Certain information contained herein has been obtained from third-party sources, which may include portfolio companies of funds managed by CoinFund. While taken from sources believed to be reliable, CoinFund has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by CoinFund. An offer to invest in a CoinFund fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by CoinFund, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by CoinFund (excluding investments for which the issuer has not provided permission for CoinFund to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://www.coinfund.io/portfolio.

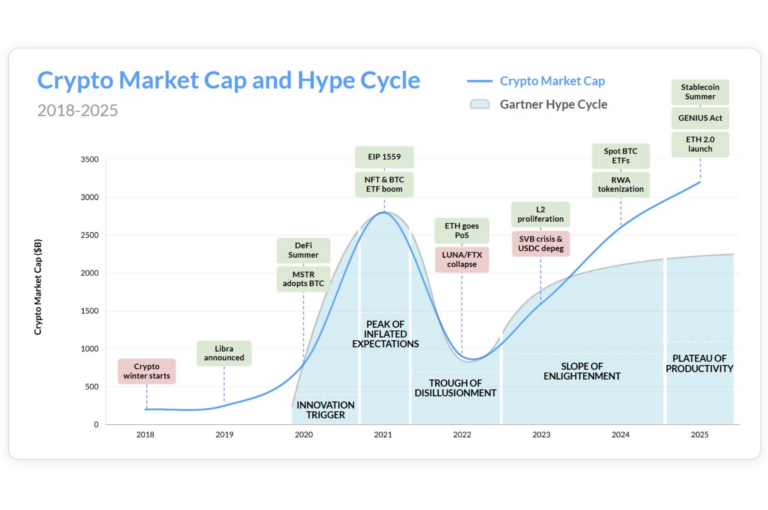

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. This presentation contains “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results may differ materially and adversely from those reflected or contemplated in the forward-looking statements.

Dilveer Vahali is Head of Venture Legal at CoinFund, responsible for legal deal strategy and execution, and serving as a resource to our portfolio companies. Dilveer brings a decade of experience advising on M&A, venture capital investments and other transactional law matters. Most recently, Dilveer was the General Manager and Lead Counsel at TCG Crypto where he acted as the general counsel and COO of the fund, leading deal execution, strategy and operations.

Prior to his work with The Chernin Group, where he also served as Deputy General Counsel for the funds at large, Dilveer was a Partner at Kirkland & Ellis LLP, where he focused his practice on private equity and mergers & acquisitions. Dilveer has also served as a financial analyst in Citigroup’s Corporate Mergers & Acquisitions group and is currently a Lecturer in Law at the University of Southern California, Gould School of Law. He has been recognized by Super Lawyers as a ‘Rising Star’ each year from 2018-2021.